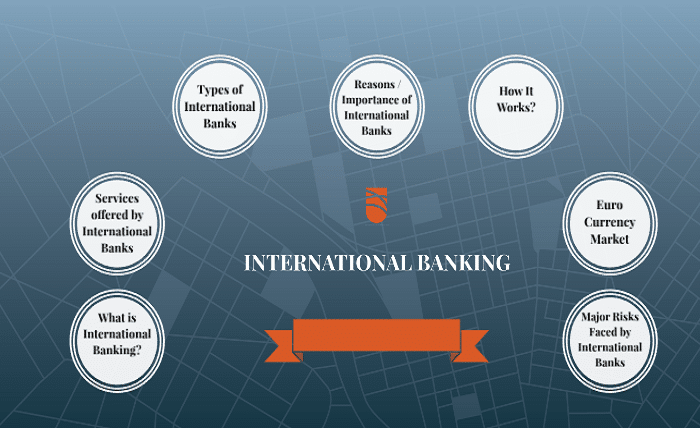

A Guide to International Banking: How It Works and What You Need to Know

Have you ever wondered about the workings of international banking? These questions are crucial for anyone dealing with global transactions. This guide provides an overview of international banking, covering how it operates and the key points you should be aware of.

What Is International Banking?

The Basics

It involves financial services provided by institutions that operate across borders. These services enable customers to manage financial transactions with entities in other countries. International banking is vital in facilitating global economic activities, whether for personal or business purposes.

The Importance of Banking Systems

International banking systems form the foundation of global finance. They ensure the smooth execution of transactions, currency exchanges, and transfers across nations. They support global trade, investment, and economic stability by enabling efficient money movement.

How Global Banking Functions

Cross-Border Transactions

One of its significant features is handling cross-border transactions. These involve the transfer of money between countries. Financial institutions utilise international banking systems to process these transfers, ensuring security and efficiency. This process is essential for businesses operating globally and individuals sending funds abroad.

Currency Conversion Services

These systems also offer currency conversion services. They facilitate the process of exchanging one currency for another, provide competitive exchange rates, and ensure smooth conversion. This service is essential for travellers, global businesses, and those dealing with multiple currencies.

Managing Multiple Accounts

Many customers maintain accounts in different countries. Global banking allows for the management of these accounts through a single platform. Banks offer online services that enable customers to monitor and control their international accounts from anywhere. This simplifies cross-border financial management.

Why International Banking Matters

Facilitating Global Trade

Thes banks support the seamless flow of goods and services between countries. This is done by offering services like trade finance, currency conversion, and cross-border payments. Global trade would face significant challenges without these banking systems, affecting economies worldwide.

Expanding Investment Opportunities

For investors, these banks open up global markets. They provide investment services that allow customers to invest in foreign assets. Access to these markets enables investors to diversify their portfolios and explore new opportunities.

Ensuring Financial Security

International banking systems are designed with security in mind. They adhere to strict regulations to protect customers’ funds and personal information. Whether transferring money or managing accounts across borders, customers can trust that their financial activities are secure.

Key Considerations for International Banking

Fees and Costs

One important aspect to be mindful of is the fees associated. These banks may charge for services like currency conversion, international transfers, and account maintenance. Understanding these costs helps manage finances more effectively and avoid unexpected expenses.

Regulatory Compliance

Various regulations, both local and international, govern these banks. Banks must comply with these regulations to operate legally and ensure the safety of customers’ funds. It’s essential to know the regulatory environment in the countries where you engage in banking activities.

Selecting the Right Bank

Choosing the right international bank is crucial for managing global finances. Consider factors like the institution’s reputation, range of services, fees, and customer support. A well-established bank with a robust international banking system can provide the necessary tools and security for international transactions.

International banking is a complex yet essential part of global finance. Understanding how international banking systems function and the key considerations involved allows you to make informed decisions about managing finances across borders. These banks offer the services needed to facilitate your financial activities effectively.